Insights

All Categories

Sole Practitioners: Benefits of Working with a Team

I regularly meet tax accounting professionals who are burned out from working in a large firm. Some of these brave ...

Making Life #LessTaxing!

This hashtag summarizes so much of what we do at Nichols & Company CPAs.

We work hard to make life ...

Recently, the growing shortage of accountants made local news in my area. While there’s still a wealth of talent ...

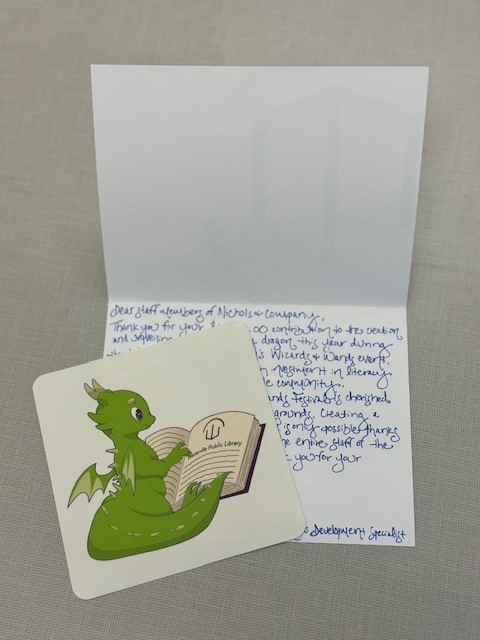

Helping Hatch a New Baby Dragon!

N&Co is so pleased to have made a donation to help bring a baby dragon to life at the Westerville Public ...

Potential Changes to Tax Law Looming for 2026; Tax Professionals Advise Planning Now

If the Tax Cuts and Jobs Act of 2017 (TCJA) expires at midnight on December 31, 2025, your tax situation could be ...

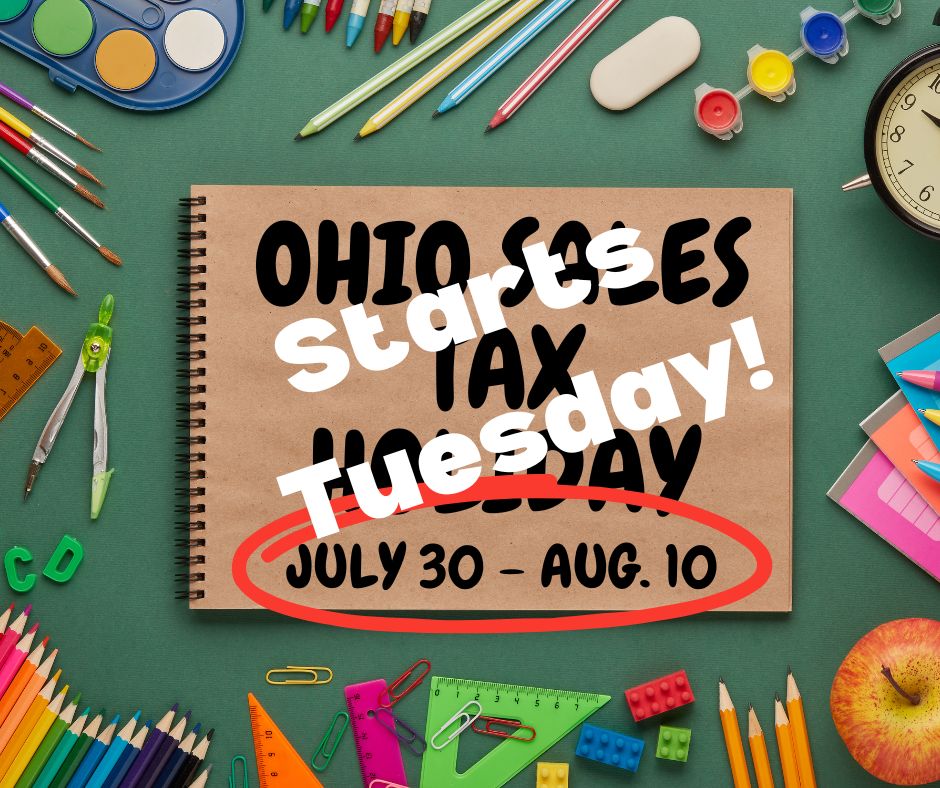

Almost celebration time: Ohio’s expanded Sales Tax Holiday starts July 30

Shoppers, start your engines. Ohio’s expanded Sales Tax Holiday will take place from 12:00 a.m. Tuesday, July 30 ...

It’s National Intern Day — Introducing Nathan Morey

It's National Intern Day, and we would like to let our amazing intern, Nathan Morey, introduce ...

Important Changes to the FAFSA Form

The Federal Application For Student Aid (FAFSA) has undergone some significant changes designed to simplify the ...

From Tax Breaks to Eclipse Breaks

While we didn't close for the day, we did take a short break from preparing taxes to enjoy today's ...

N&Co Chili Cook-Off

When you only work about 15 Fridays per year, you like to make them special. Today was our Chili Cook-Off! We had ...

A Heartfelt Thank You from Us to You!

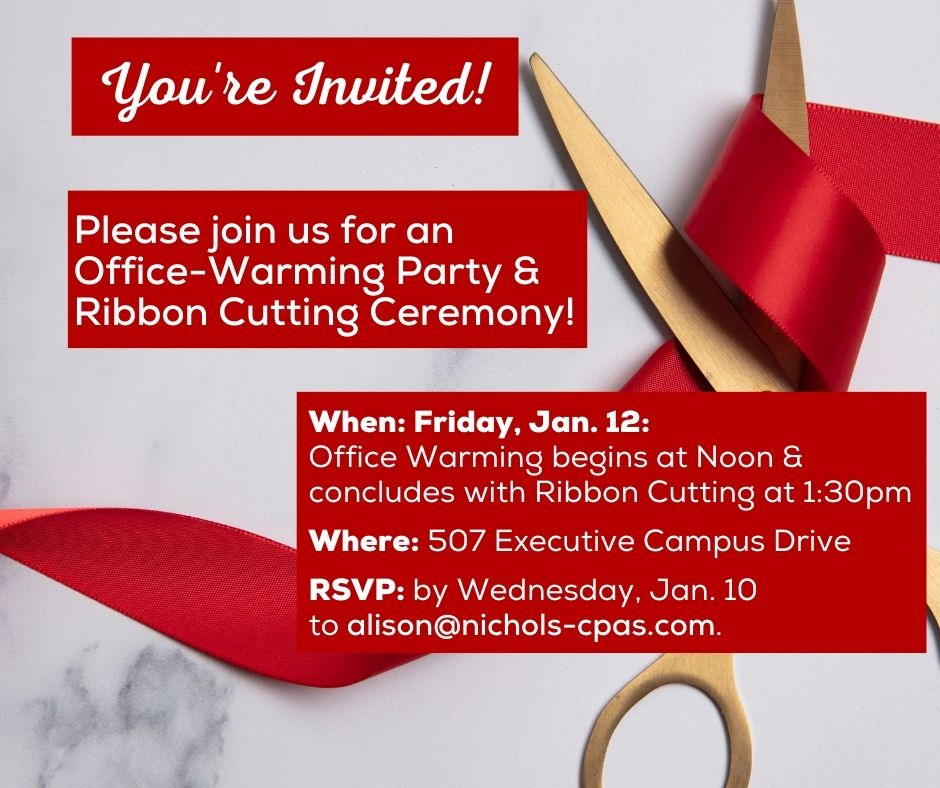

We at Nichols & Company, CPAs would like to thank everyone who came out last Friday to celebrate and tour our ...

Join Us Friday, Jan. 12 for an Office-Warming Party & Ribbon Cutting! (Please RSVP by Jan. 10)

No results found.