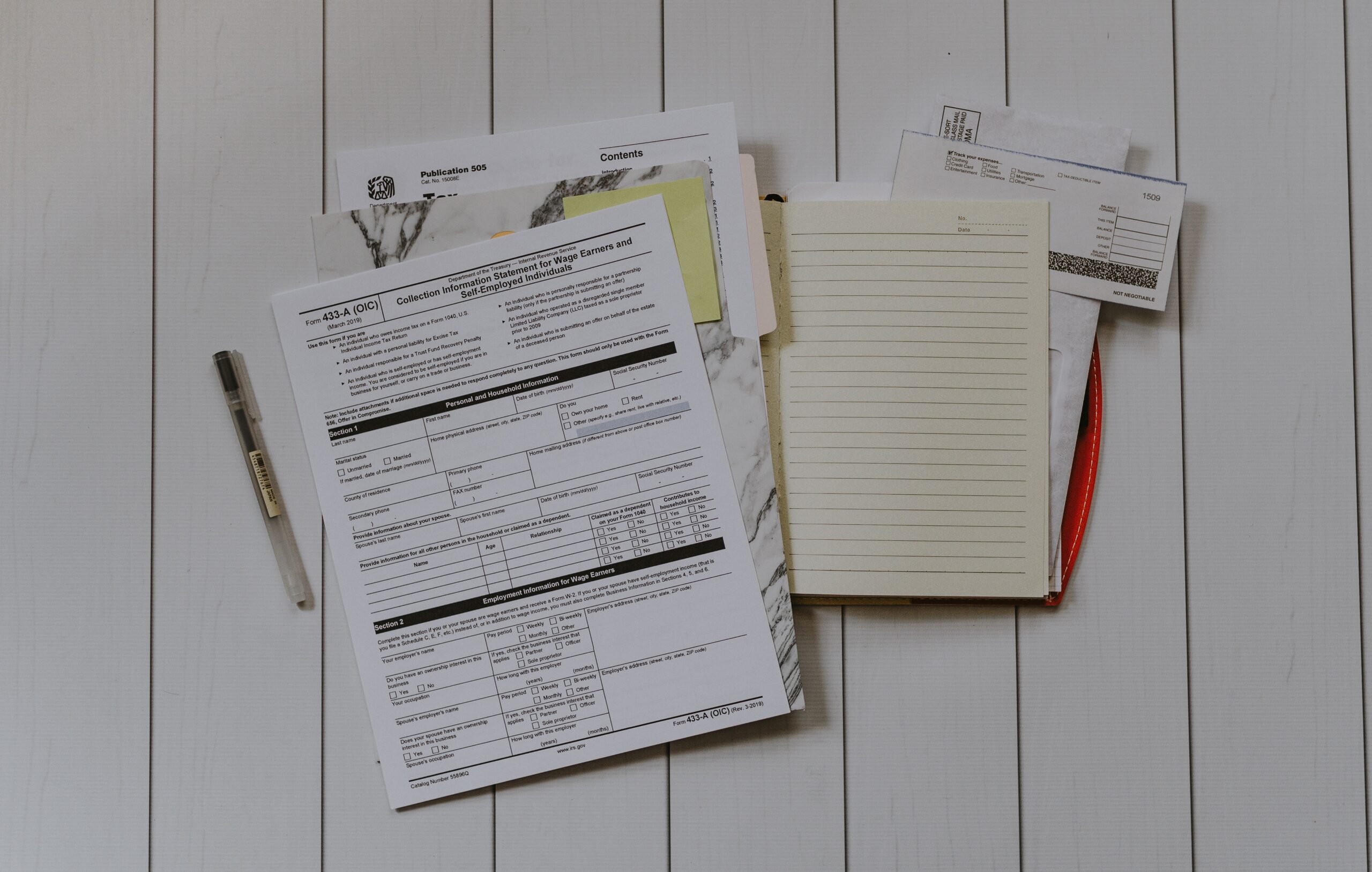

Attention All Self-Employed Individuals & Business Partners

The IRS recently approved a temporary 100% deduction for some business meal expenses incurred during the 2021 and 2022 calendar years. In order to qualify, expenses must meet the following criteria: Paid or incurred after 12/31/20 and before 01/01/2023 with the meal...

IRS Releases 2021 Standard Mileage Rates

The Internal Revenue Service today issued the 2021 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business, charitable, medical or moving purposes. Beginning on January 1, 2021, the standard mileage rates for...

Several Ohio Counties Have Granted Extensions to Pay Property Taxes

Note: each county appears to have their own new due date! Belmont (from July 20, 2020 to August 21, 2020) Cuyahoga (from July 20, 2020 to August 13, 2020) Delaware (from July 20, 2020 to August 20, 2020) Franklin (from July 20, 2020 to August 5, 2020) Geauga (from...

Business Owners: There Are 3 New Tax Credits Available to Companies Hit By COVID-19

The IRS wants to remind business owners of 3 new credits available to companies hit by COVID-19. Please click the links to learn more about how your business can benefit from the Employee Retention Credit, the Paid Sick Leave Credit and the Paid Family Leave Credit....