Introducing Your New & Improved Tax Organizer!

We want to wish you and your families a very Happy New Year! The team at N&Co is eager to support you in navigating tax season seamlessly. In early January, we will begin emailing you a series of tips geared toward completing your Tax Organizer, as well as...

EVs: Here Is The Information You Need To Qualify For The Clean Vehicle Credit

Did you purchase an electric vehicle in 2023? Here is the information you need to qualify for the Clean Vehicle credit: The seller of the vehicle must provide the buyer with a report at the time of sale. This report will verify that the vehicle and its battery are...

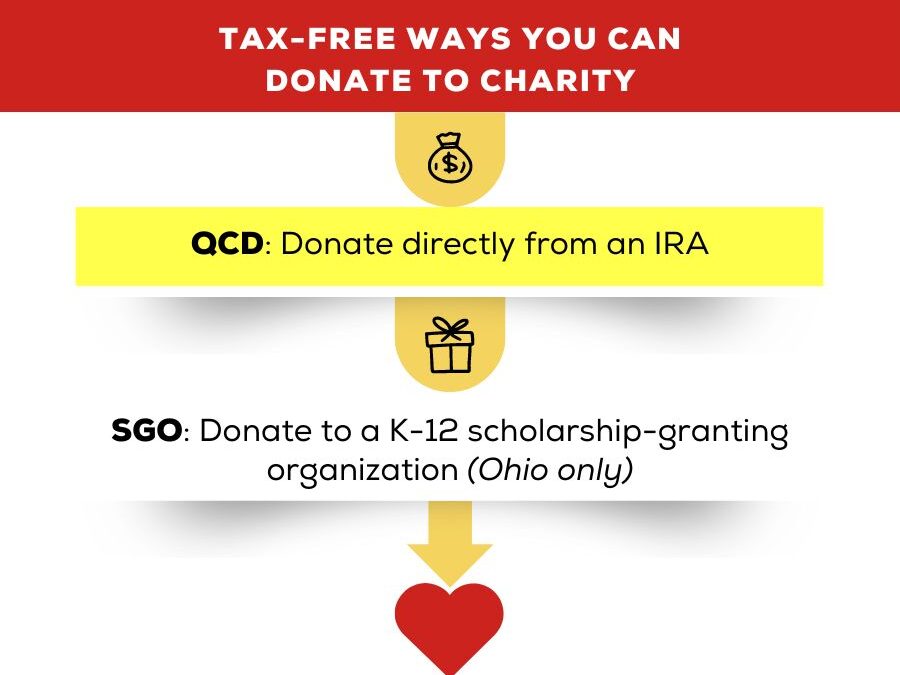

Qualified Charitable Distributions Excellent Way to Satisfy Your RMD

IRA owners, age 70 ½ or older, are eligible to transfer up to $100,000 tax-free directly to the charity of their choice. Each year, an IRA owner, age 70½ or over when the distribution is made, can exclude from gross income up to $100,000 of these qualified charitable...

Some Very Important Updates For Clients

Happy Holidays! We are quickly approaching our favorite time of the year—Tax Season—and have some very important updates to share with you: There is still time for 2023 year-end tax planning, and planning is more important than ever. The IRS interest rate on...