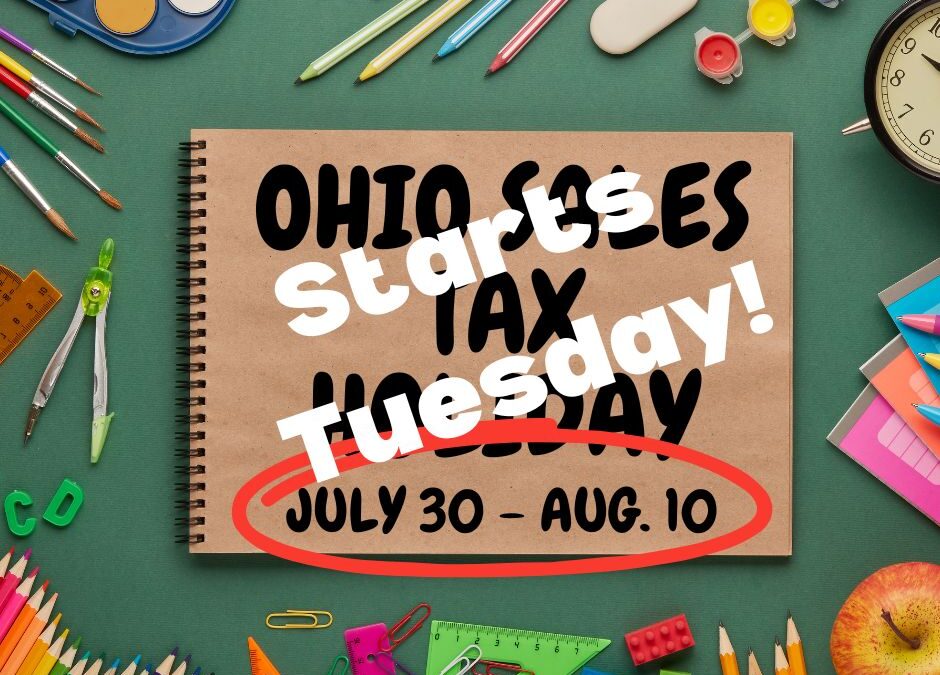

Almost celebration time: Ohio’s expanded Sales Tax Holiday starts July 30

Shoppers, start your engines. Ohio’s expanded Sales Tax Holiday will take place from 12:00 a.m. Tuesday, July 30 until 11:59 p.m. Thursday, August 8. The length of Ohio’s Sales Tax holiday has been expanded to 10 days and will allow tax-free purchases made in-person...

Important Changes to the FAFSA Form

The Federal Application For Student Aid (FAFSA) has undergone some significant changes designed to simplify the application process. Here are some key items to be aware of: Introduction of “Contributor”: A contributor is the new terms for anyone who is asked to...

Tax-Time Trivia To Help You Prepare For Tax Season

Happy New Year! To help you prepare for our new Tax Organizer, we have compiled some fun facts into quick and easy trivia (a 30-second or less read). Please read them all to help us make your life less taxing. Question 1 –TRUE OR FALSE: This year, I must complete and...

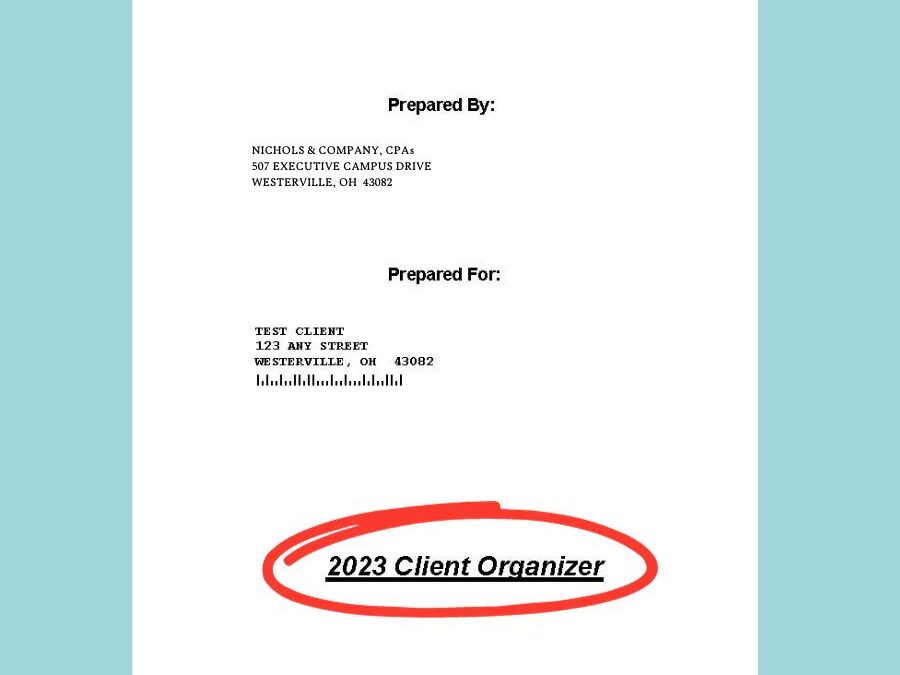

Introducing Your New & Improved Tax Organizer!

We want to wish you and your families a very Happy New Year! The team at N&Co is eager to support you in navigating tax season seamlessly. In early January, we will begin emailing you a series of tips geared toward completing your Tax Organizer, as well as...