Blog

A Heartfelt Thank You from Us to You!

We at Nichols & Company, CPAs would like to thank everyone who came out last Friday to celebrate and tour our new office space, and participate in our ribbon cutting. We were overwhelmed by your outpouring of support and encouragement. Such a warm response from...

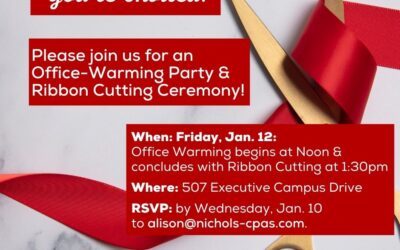

Join Us Friday, Jan. 12 for an Office-Warming Party & Ribbon Cutting! (Please RSVP by Jan. 10)

Tax-Time Trivia To Help You Prepare For Tax Season

Happy New Year! To help you prepare for our new Tax Organizer, we have compiled some fun facts into quick and easy trivia (a 30-second or less read). Please read them all to help us make your life less taxing. Question 1 –TRUE OR FALSE: This year, I must complete and...

Introducing Your New & Improved Tax Organizer!

We want to wish you and your families a very Happy New Year! The team at N&Co is eager to support you in navigating tax season seamlessly. In early January, we will begin emailing you a series of tips geared toward completing your Tax Organizer, as well as...

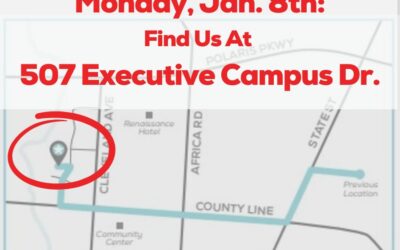

It’s Official: We’re Moving!

Just another reminder that we are moving and will be fully operational at our new location (507 Executive Campus Drive in Westerville) on Monday, January 8th! Our new location is easy to find and less than two miles from the current office. We look forward to...

EVs: Here Is The Information You Need To Qualify For The Clean Vehicle Credit

Did you purchase an electric vehicle in 2023? Here is the information you need to qualify for the Clean Vehicle credit: The seller of the vehicle must provide the buyer with a report at the time of sale. This report will verify that the vehicle and its battery are...

Business Owners: Changes to Commercial Activity Tax Explained

You may have received a letter regarding your CAT Tax account. Beginning on January 1, 2024, the commercial activity tax (CAT) annual minimum tax is eliminated, and the exclusion amount is increased from $1 million to $3 million. Therefore, taxpayers with taxable...

Qualified Charitable Distributions Excellent Way to Satisfy Your RMD

IRA owners, age 70 ½ or older, are eligible to transfer up to $100,000 tax-free directly to the charity of their choice. Each year, an IRA owner, age 70½ or over when the distribution is made, can exclude from gross income up to $100,000 of these qualified charitable...

Some Very Important Updates For Clients

Happy Holidays! We are quickly approaching our favorite time of the year—Tax Season—and have some very important updates to share with you: There is still time for 2023 year-end tax planning, and planning is more important than ever. The IRS interest rate on...