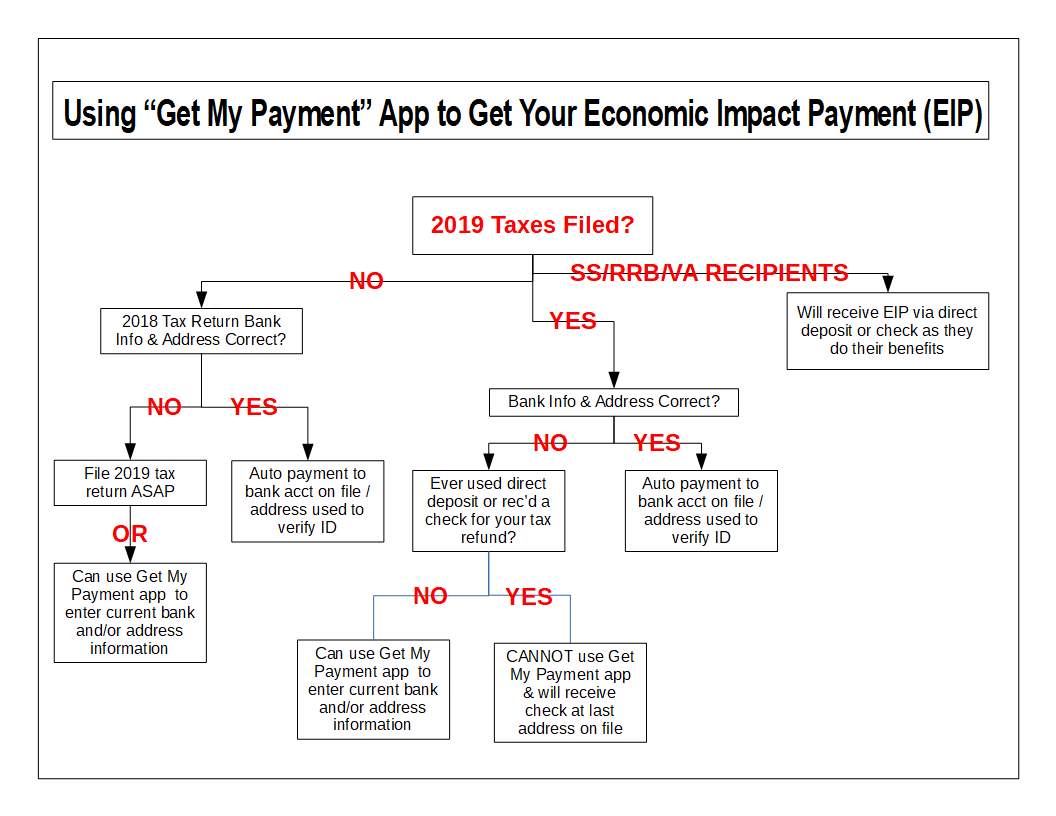

We are still receiving questions from a number of our clients in regards to the Economic Impact Payments (EIP). Here is a recap of the qualifiers, a helpful flow chart (below) and useful links for more information.

Who Qualifies?

- Individuals with an adjusted gross income (AGI) up to $75,000 or married couples filing jointly with an AGI up to $150,000 will receive the full EIP of up to $1,200 per person and $500 for each child under 17.

- Tax filers with incomes above $150,000 but below $199,000 will see their EIP reduced by $5 for each $100 they are above the $75,000/$150,000 thresholds.

- Tax filers with Head of Household status making less than $136,500

- Social Security recipients and railroad retirees who aren’t required to file annual returns are still eligible to receive payments.

Who Does NOT Qualify?

- Anyone aged 17 or older who is listed as a dependent on a tax return.

This is an advance payment of a 2020 income tax credit. Therefore, those whose AGI in 2020 ends up being lower than their last filed tax return, or those who had a child in 2020, will receive a credit for the difference on their 2020 income tax return. Those who receive a larger credit than they would be entitled to in 2020 will not have to repay the difference.

Calculate your Economic Impact Payment (EIP)

To check on EIP status or update address/bank info, Filers Click Here

To check on EIP status or update address/bank info, Non-Filers Click Here

Beware of Scams

Additionally, the IRS reminds those expecting an EIP to be on guard for scams. Please remember the IRS will NEVER contact you by phone, email, text or social media to request your bank account or social security numbers or any other personal information. Do not click on links in emails that purport to have information about your EIP.