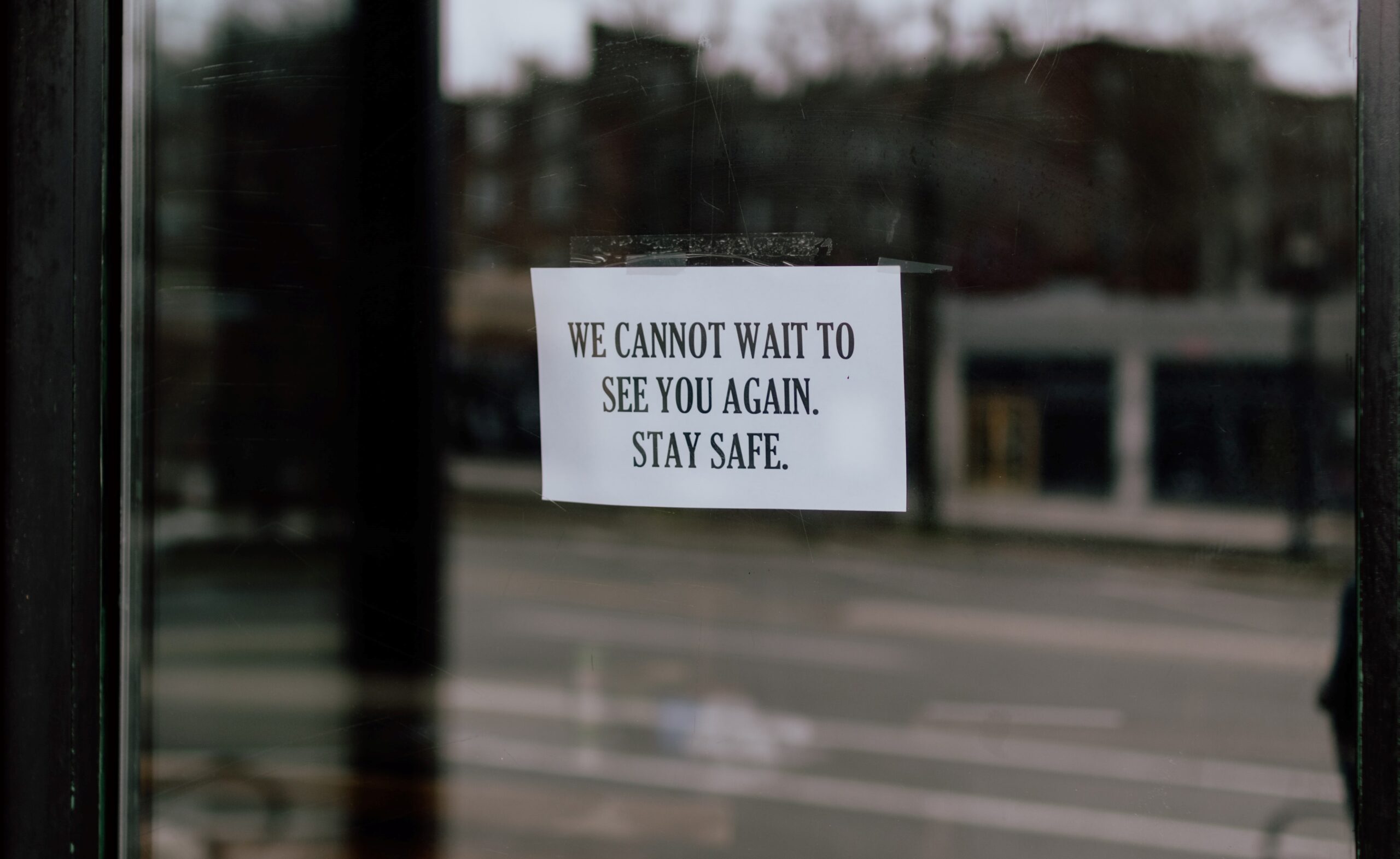

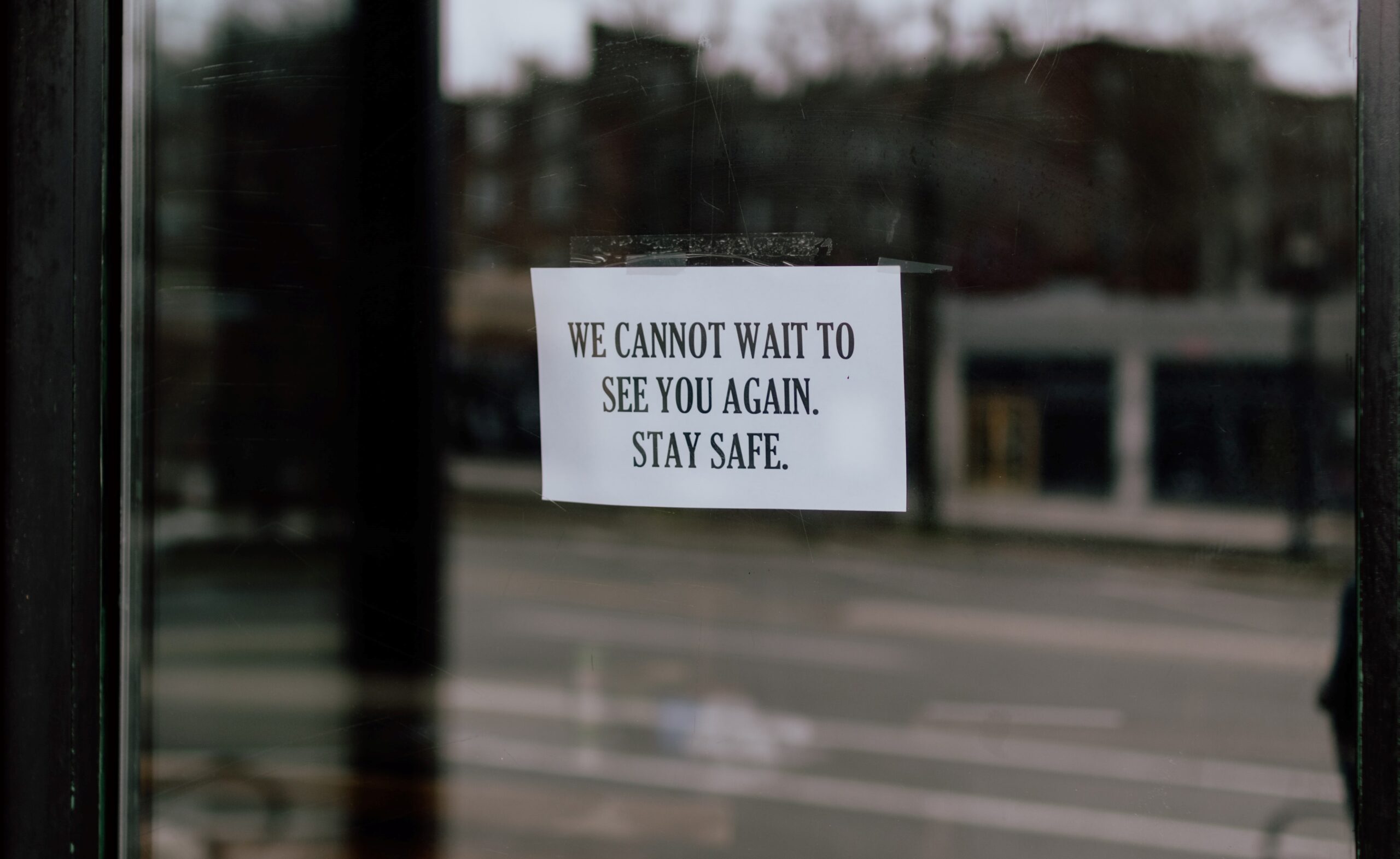

May 27, 2020 | Business Consulting, COVID-19

We are always here to address the accounting needs of our business clients, but we are also aware that now, more than ever, businesses are facing some new HR concerns. Business owners have new responsibilities, designed to keep employees and customers safe. Also some...

May 7, 2020 | Business Consulting, Corporate Tax, COVID-19, IRS

The IRS wants to remind business owners of 3 new credits available to companies hit by COVID-19. Please click the links to learn more about how your business can benefit from the Employee Retention Credit, the Paid Sick Leave Credit and the Paid Family Leave Credit....

Apr 23, 2020 | Business Consulting, Corporate Tax, COVID-19

Recently, a number of our clients were unable to apply for the Payroll Protection Program before the first round of money ran out. Today Congress approved additional funds, so we encourage those who qualify to move quickly to secure loans from this second round of...

Apr 21, 2020 | Business Consulting, Corporate Tax, COVID-19

Many small businesses are feeling the strain created by the coronavirus restrictions. We encourage our clients who would benefit from a Paycheck Protection Program (PPP) loan to take advantage of it. In this Forbes article, author Jason Freeman breaks down the...

Apr 2, 2020 | Business Consulting, COVID-19, Uncategorized

There are a couple additional loan options for small business owners who are struggling right now: the Paycheck Protection Program (PPP) and Economic Injury Disaster Loans (EIDL). The PPP offers applicants funds in the form of loans that can be fully forgiven when...

Jan 5, 2020 | Accounting & Quickbooks, Business Consulting, Corporate Tax, IRS, Personal Tax, Tax Planning, Uncategorized

The IRS recently released the mileage rates for 2020. Beginning Jan. 1, the business mileage rate decreased one-half of a cent for business travel driven and three cents for medical and certain moving expenses as compared to the rates for 2019. The charitable rate is...