Apr 23, 2020 | Business Consulting, Corporate Tax, COVID-19

Recently, a number of our clients were unable to apply for the Payroll Protection Program before the first round of money ran out. Today Congress approved additional funds, so we encourage those who qualify to move quickly to secure loans from this second round of...

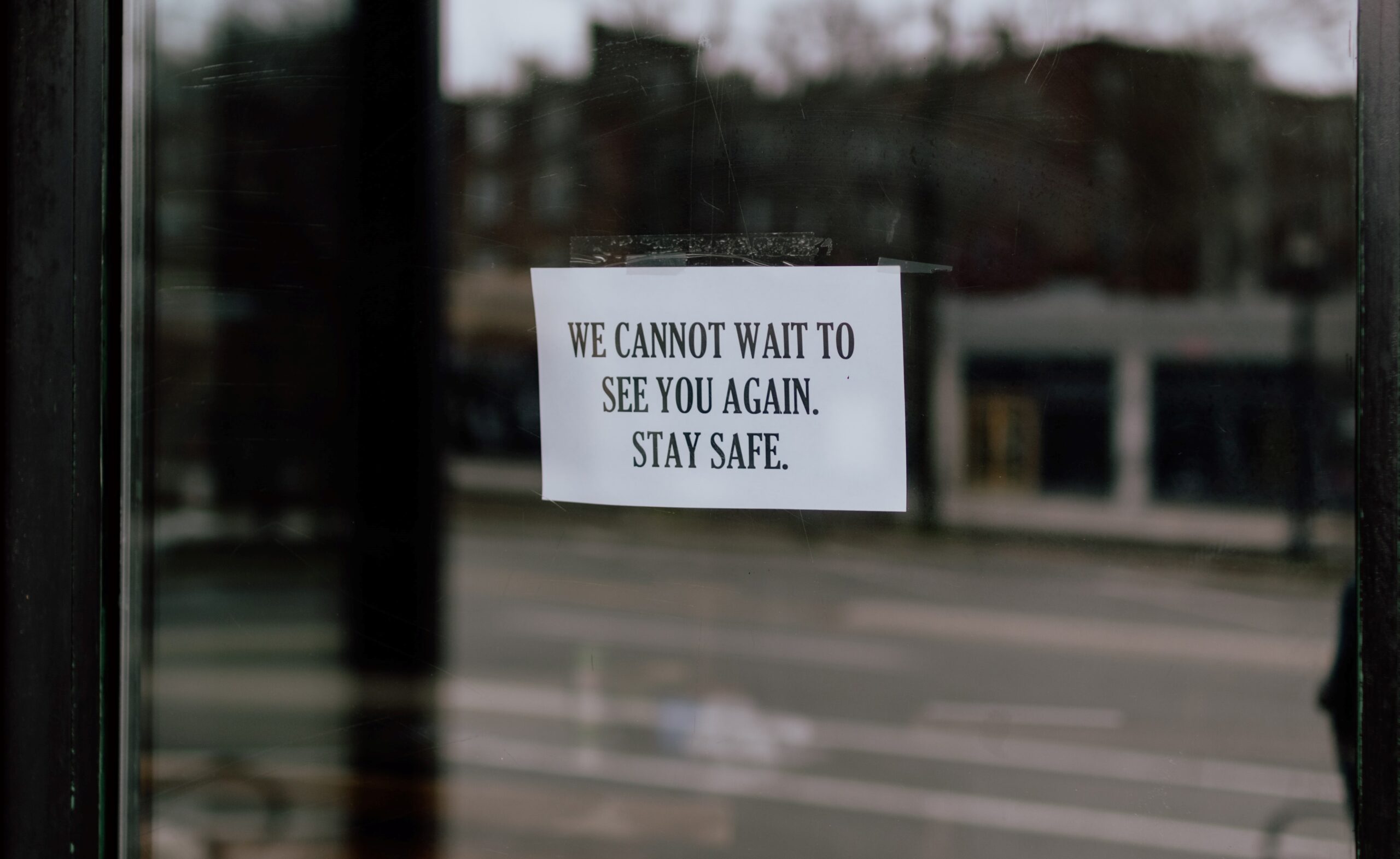

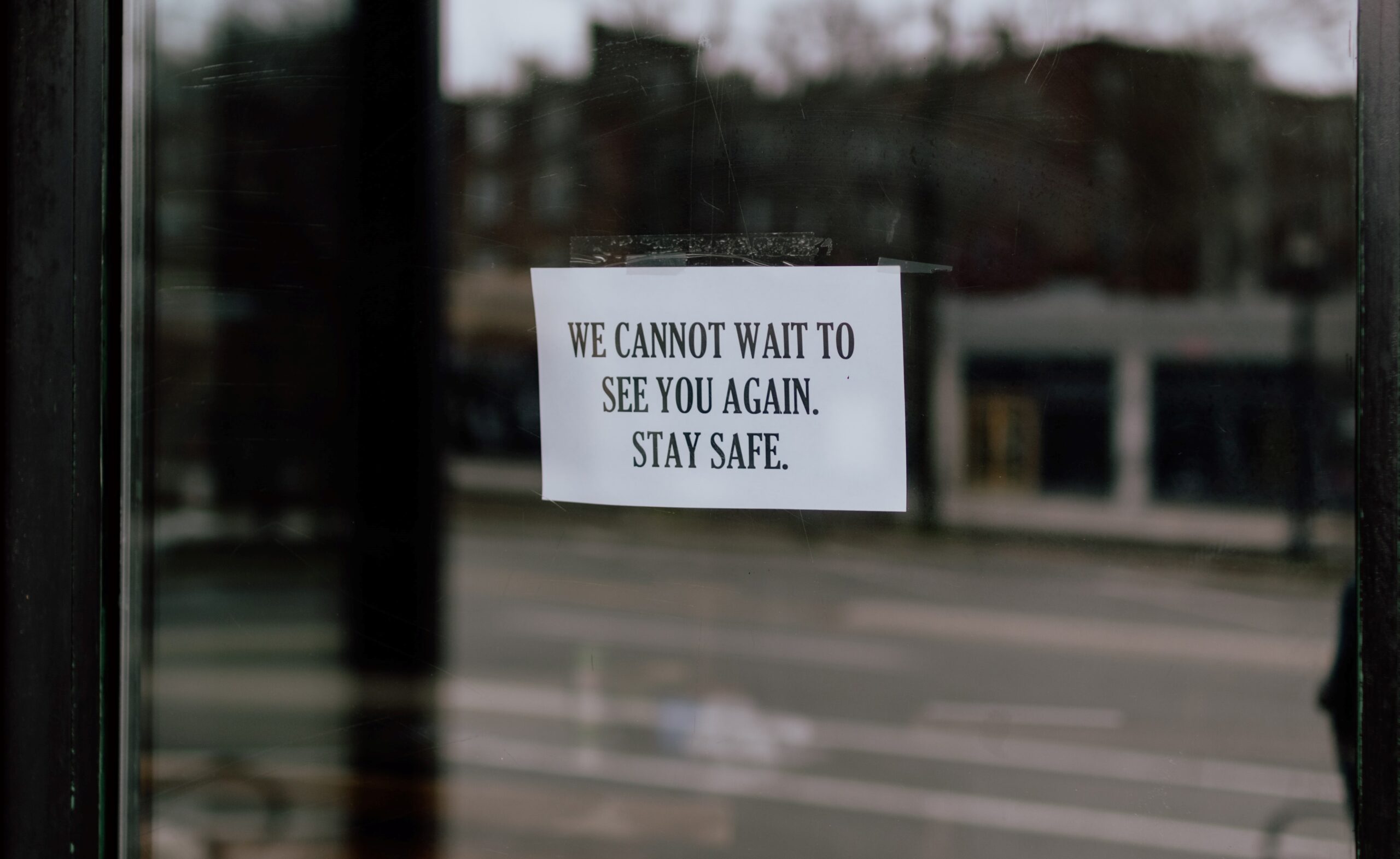

Apr 21, 2020 | Business Consulting, Corporate Tax, COVID-19

Many small businesses are feeling the strain created by the coronavirus restrictions. We encourage our clients who would benefit from a Paycheck Protection Program (PPP) loan to take advantage of it. In this Forbes article, author Jason Freeman breaks down the...

Jan 5, 2020 | Accounting & Quickbooks, Business Consulting, Corporate Tax, IRS, Personal Tax, Tax Planning, Uncategorized

The IRS recently released the mileage rates for 2020. Beginning Jan. 1, the business mileage rate decreased one-half of a cent for business travel driven and three cents for medical and certain moving expenses as compared to the rates for 2019. The charitable rate is...

Sep 5, 2019 | Business Consulting, Corporate Tax

Many of our clients are pass-through entities and sole-proprietorships. Ohio tax law has been very generous to these entities over the past several years, but there are now some changes to those laws. Part of the value of a CPA relationship is knowing that we will...

Jul 10, 2019 | Accounting & Quickbooks, Business Consulting, Corporate Tax

Reconciling your accounts is so important that Brea’s 13-year-old daughter already has it ingrained in her brain! Take a minute to watch as she guides you through the various reasons all businesses should reconcile their books each month. We are seeing errors when it...