Nov 25, 2024 | Personal Tax, Tax Planning

If you’re concerned about a potential April tax liability, it might make more sense than ever to do some tax planning before the year ends. Also, we strongly encourage you to reach out to us if you’ve experienced any of the following major life events this year:...

Nov 20, 2024 | Tax Planning

With President-elect Donald Trump winning a second term in the November 5 election, we have a clearer picture of what tax policies will be at the forefront of discussions as we head into 2025 and the scheduled expiration of many Tax Cuts and Jobs Act (TCJA)...

Oct 21, 2024 | Tax Planning

If you have experienced a major life event, for instance retirement, marriage, divorce, birth of a child, change in personal or business income, sale of property, etc., contact us to identify time-sensitive tax-savings opportunities for 2024 and perhaps 2025, as well....

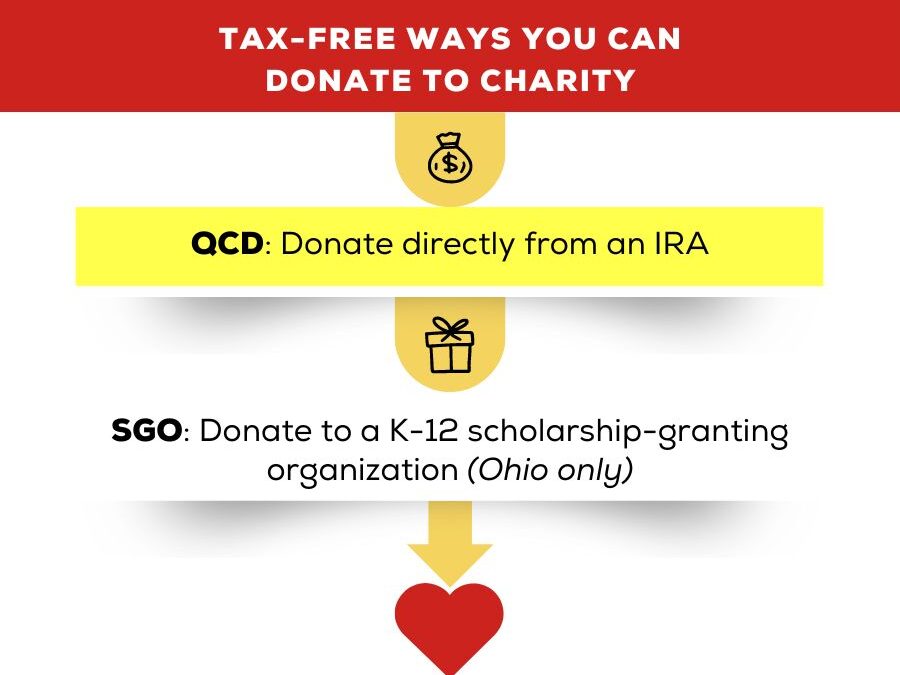

Dec 16, 2023 | Personal Tax, Tax Planning

IRA owners, age 70 ½ or older, are eligible to transfer up to $100,000 tax-free directly to the charity of their choice. Each year, an IRA owner, age 70½ or over when the distribution is made, can exclude from gross income up to $100,000 of these qualified charitable...

Jan 31, 2023 | Personal Tax, Tax Planning

The annual gift reporting threshold has increased to $17,000 per recipient in 2023. This means that married taxpayers who elect to gift-split can make gifts of up to $34,000 per recipient annually without generating a taxable gift. We want to point out that the...