May 29, 2025 | Education, Personal Tax

May 29 is National 529 Day—a good reminder to take a closer look at how these savings accounts can support education goals while delivering meaningful tax advantages. While many families are familiar with the basic features of 529s, there are several planning...

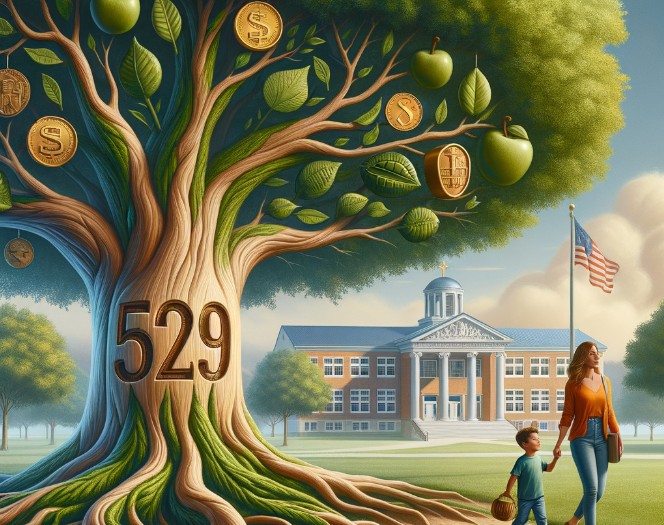

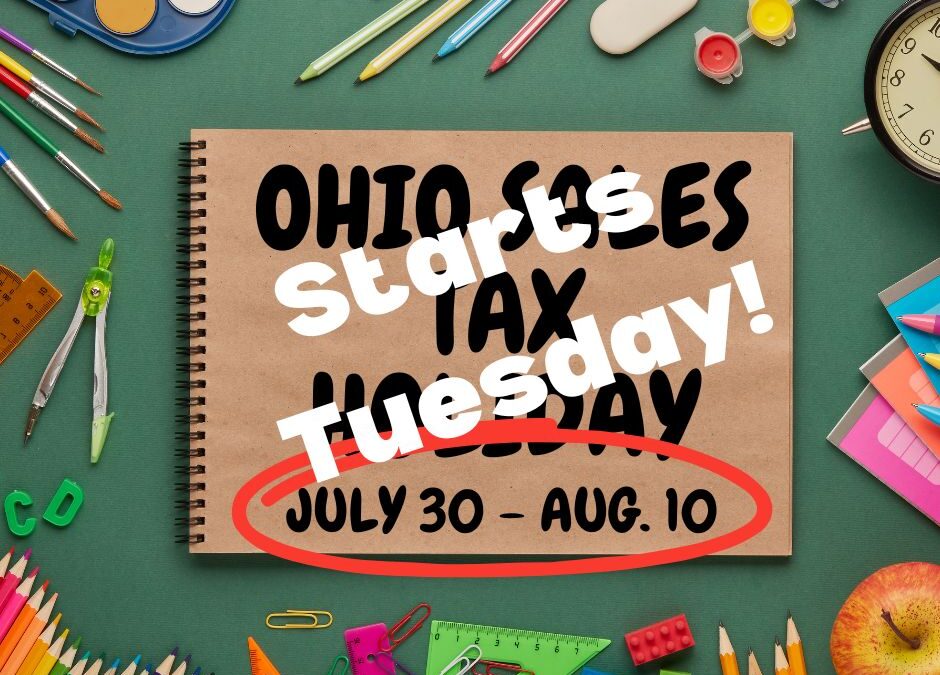

Jul 27, 2024 | Education, Personal Tax

Shoppers, start your engines. Ohio’s expanded Sales Tax Holiday will take place from 12:00 a.m. Tuesday, July 30 until 11:59 p.m. Thursday, August 8. The length of Ohio’s Sales Tax holiday has been expanded to 10 days and will allow tax-free purchases made in-person...

Jun 12, 2024 | Education, Personal Tax

The Federal Application For Student Aid (FAFSA) has undergone some significant changes designed to simplify the application process. Here are some key items to be aware of: Introduction of “Contributor”: A contributor is the new terms for anyone who is asked to...

Jul 26, 2023 | Education, Personal Tax

As many of us prepare for back-to-school season, we wanted to send a reminder that Ohioans donating money to scholarship-granting organizations (SGOs) are eligible to receive a nonrefundable, dollar-for-dollar tax credit up to $750 (or $1,500 for married couples...

Dec 21, 2022 | Education, Personal Tax

Ohioans donating money to scholarship-granting organizations (SGOs) are eligible to receive a dollar-for-dollar tax credit up to $750 (or $1,500 for married couples filing jointly*) for these donations. The credit is limited either by the amount donated or your total...

Dec 15, 2022 | Education, Personal Tax

Dear Clients,We aim to build a better experience for a life that is #LessTaxing! Below please find a copy of our series of brief emails aimed at helping us both to work together to be more efficient at preparing your return(s). And remember: we are always here...