Jan 4, 2024 | Personal Tax

Happy New Year! To help you prepare for our new Tax Organizer, we have compiled some fun facts into quick and easy trivia (a 30-second or less read). Please read them all to help us make your life less taxing. Question 1 –TRUE OR FALSE: This year, I must complete and...

Dec 28, 2023 | Personal Tax

We want to wish you and your families a very Happy New Year! The team at N&Co is eager to support you in navigating tax season seamlessly. In early January, we will begin emailing you a series of tips geared toward completing your Tax Organizer, as well as...

Dec 21, 2023 | Personal Tax

Did you purchase an electric vehicle in 2023? Here is the information you need to qualify for the Clean Vehicle credit: The seller of the vehicle must provide the buyer with a report at the time of sale. This report will verify that the vehicle and its battery are...

Dec 16, 2023 | Personal Tax, Tax Planning

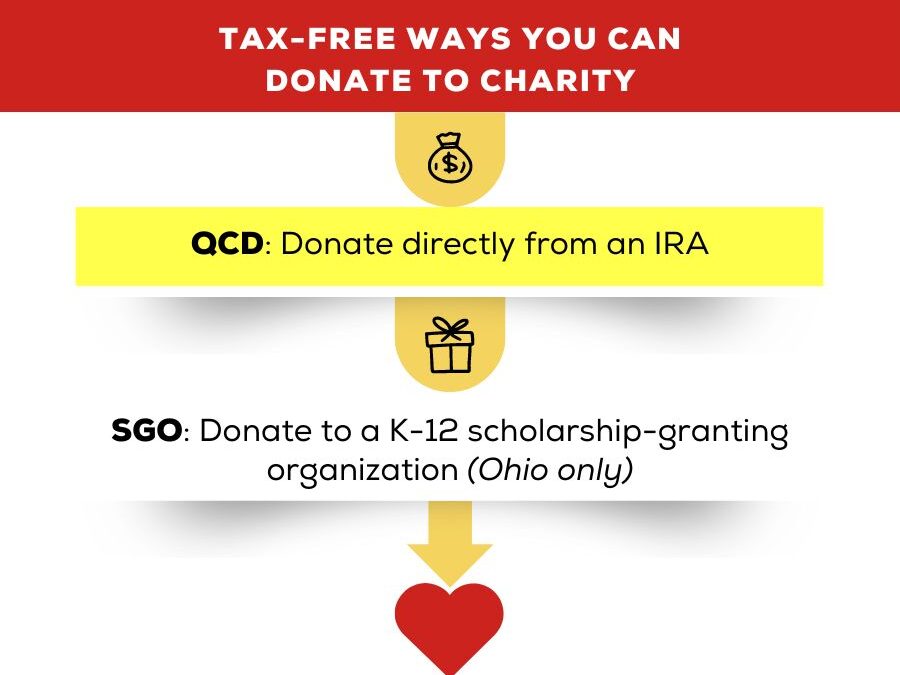

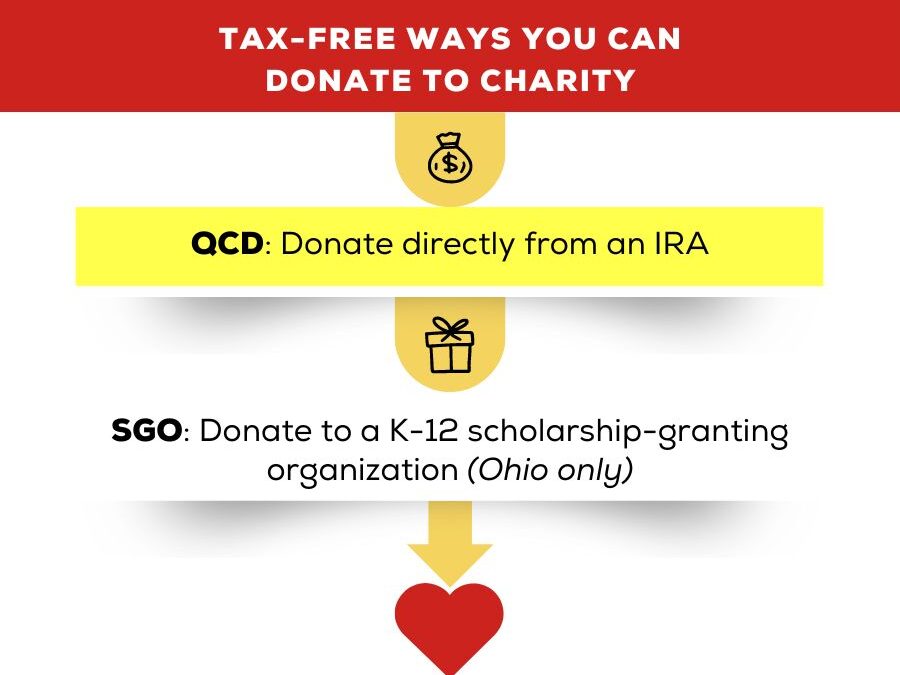

IRA owners, age 70 ½ or older, are eligible to transfer up to $100,000 tax-free directly to the charity of their choice. Each year, an IRA owner, age 70½ or over when the distribution is made, can exclude from gross income up to $100,000 of these qualified charitable...

Dec 12, 2023 | Firm News, Personal Tax

Happy Holidays! We are quickly approaching our favorite time of the year—Tax Season—and have some very important updates to share with you: There is still time for 2023 year-end tax planning, and planning is more important than ever. The IRS interest rate on...

Nov 28, 2023 | Personal Tax

On this Giving Tuesday, we wanted to remind our Ohio clients of a unique opportunity to make a positive impact in the community while also benefiting from valuable tax incentives. Did you know that contributing to scholarship-granting organizations (SGOs) can earn you...