Insights

All Categories

Boost Your Retirement Savings In 2023

The IRS recently announced cost-of-living adjustments to pension and retirement fund contributions beginning in ...

Preventing Fraud for Business Accounts

Jeff Kopco at First Federal Lakewood shares tips for identifying scam emails, spoofing and smishing attempts. All ...

Children & Income Tax: 3 Tips

As we pack up our students and send them off to school, here are three tips around kids, college students and ...

Electric Vehicle Tax Credit Changes Effective Immediately

The Inflation Reduction Act introduces a number of significant changes to the tax credit for new electric ...

Reminders & Tips for SafeSend Returns Users (Digital Tax Return Delivery)

We know it's summer and most of you aren't thinking taxes; however, we've heard from a few of you about needing to ...

Would You Recognize the Signs of Data Theft?

In today’s day and age, protecting your identity and personally identifiable information is critical. How familiar ...

Rising Gas Prices Bring About Increase In Federal Standard Mileage Rates

In recognition of rising gas prices, the IRS has announced a rare increase to the optional standard mileage rate ...

Have You Considered Utilizing Your HSA as a Savings Tool?

Individuals covered by a qualifying high-deductible health insurance are eligible for a Health Savings Account. ...

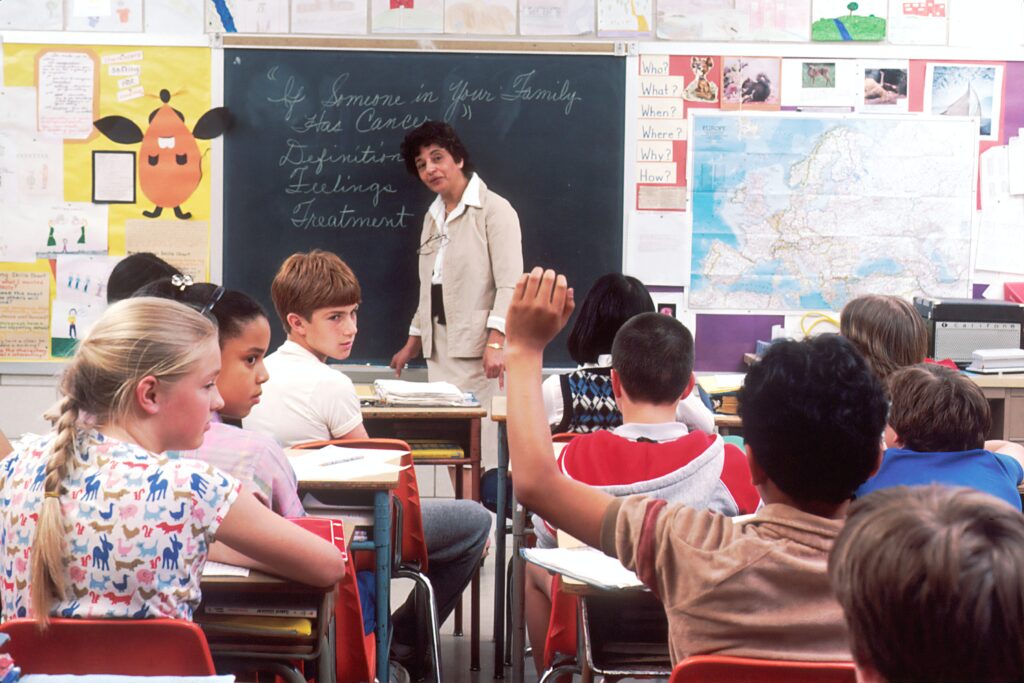

Ohio Offers A Newer Tax Credit to Citizens Supporting K-12 Educational Scholarships

Ohioans donating money to scholarship-granting organizations (SGOs) are eligible to receive a dollar-for-dollar ...

Can I Claim My Child & Dependent Care On My 2021 Tax Return?

The Child & Dependent Care Credit underwent major changes in 2021 as part of the American Rescue Plan Act. The ...

Why Aren’t Most GoFundMe Crowdfunding Payments Considered Charitable Contributions?

Donations made to a personal GoFundMe fundraiser, rather than a charity fundraiser, are generally considered to be ...

Charitable Donations of Household Goods – How Do I Determine a Dollar Value?

On our website under the Tools/Links tab, you can scroll down to the heading General Links where you'll find a ...

No results found.